Blog: Activities that promote CSA practices’ adoption – the Case of Weather Index Based Insurance (WIBI)

Smallholder farmers in Burkina Faso, confronted to a multitude of challenges, are among the most exposed to the risks associated with climate change (floods and severe droughts). These risks constrain farmers’ from investing in measures that might increase their productivity and improve their economic situation and welfare [1]. Indeed, farmers frequently exhibit a high aversion to risk and this aversion has been used to explain their unresponsiveness to innovations. Moreover, small-scale farmers have no access to financial institutions because the terms and conditions for accessing loans are not conducive. Consequently, smallholder farmers need to adopt improved agricultural technologies and approaches and use appropriate risk management tools in order to increase farm productivity and incomes, under climate change. Two very promising solutions and practices that may boost productivity and sustainability of agriculture under climate change are: Climate-Smart Agriculture (CSA) and Weather Index Based Insurance (WIBI).

In recent years, index insurance has been presented as an important tool that can allow smallholder farmers to better manage climate risk, enabling investment and growth in the agricultural sector. This research tries to understand how possible hazard crop insurance schemes could foster adoption of CSA practices.

Weather Index Based Insurance (WIBI): It uses weather observations as proxies for losses in production or quality and does not require loss assessments. This approach solves some of the problems that limit the application of traditional crop insurance in rural parts of developing countries by reducing transaction costs, and adverse selection and moral hazard [2]. Watch a video on WIBI here.

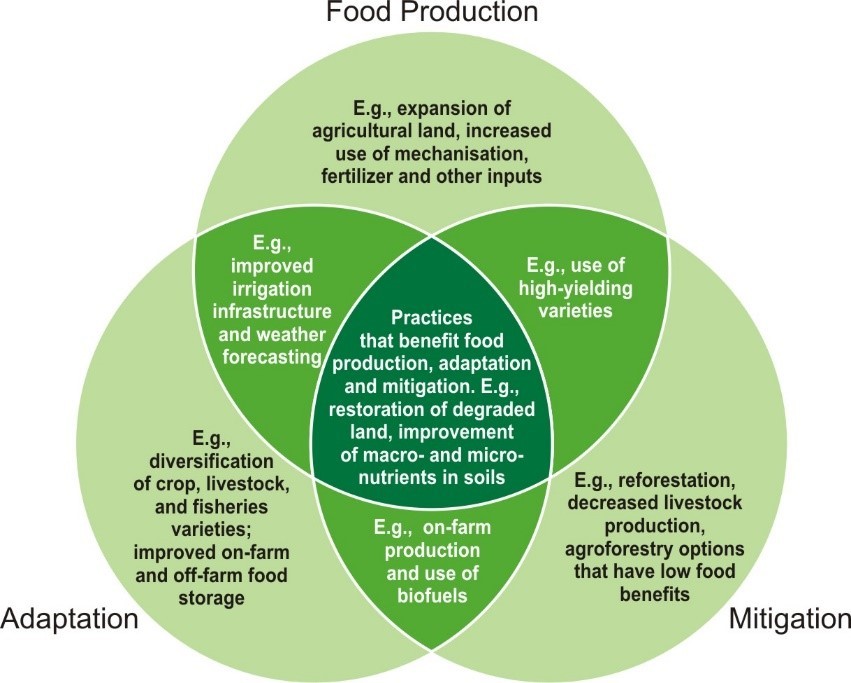

Climate-Smart Agriculture (CSA): according to the FAO, CSA refers to agriculture that sustainably increases productivity, resilience (adaptation), reduces/removes GHGs (mitigation), and enhances achievement of national food security and development goals. It integrates the three dimensions of sustainable development (economic, social and environmental) by jointly addressing food security and climate challenges (as can be seen in the figure, source).

Why has index crop insurance not worked in Burkina Faso?

To date, only small pilot programs have been implemented in West Africa. In Burkina Faso, PlaNet Guarantee is among pioneers for developing and distributing index crop insurance. But unfortunately, the take up was very low with adopters insuring only a very small fraction of their maize cropping (0.5 to 1 ha).

In August 2017, a series of group discussions were organized in order to gather information on the ongoing pilot initiative crop insurance in three regions of Burkina Faso out of the four covered by PlaNet Guarantee . According to local farmers in these areas, the low adoption rate of crop insurance was much more due to a lack of common understanding between both parties (farmers and insurers) of the definition of risk. Farmers further expressed a high interest in a crop insurance scheme, provided that such insurance is local specific (flood/drought-prone areas) and clearly defined. Demand for development index insurance will most likely become an attractive proposition in the specific hazard-prone agricultural areas [3]. An evaluation of the cost-effectiveness of drought indexed crop insurance, conducted by WASCAL between March and April 2018, revealed that about 90% of maize producers interviewed in Koumbia, one of PlaNet Guarantee pilot site, have a demand for crop insurance. The demand rate was slightly higher when the farmers were affected by extreme weather and climate events over the last three years: 93% of farmers affected by the flood were willing to pay for weather-index insurance, while 92% and 88% of farmers who have recorded losses caused by droughts and rainfall variability.

Nexus between WIBI and CSA

CSA generally reduces vulnerability to moderate weather events, but fails under extreme weather conditions, whereas insurance products are considered more appropriate to cover extreme weather events whilst covering moderate weather shocks would increase premiums beyond affordable levels [4]. WIBI promotes the adoption of CSA practices as it contributes to its three pillars: (i) it encourages adoption of new agricultural techniques- farmers can take additional risks by investing in improved practices that increase productivity and food security, even in situations of adverse weather conditions; (ii) weather-index insurance can provide an effective tool for climate risk management and climate change adaptation – farmers located in weather-related risky areas are no more limited in their decision-making; (iii) WIBI can contribute to effectively build farmers adaptive capacities to face climate change (risk management) and can play a role in fostering the reduction of GHG emissions and increasing carbon sinks by contributing to orient the intensification of agro ecosystems [5]. Its contribution to climate change mitigation will depend on the degree to which insured farmers are able to invest in improved production practices which either enhance carbon sequestration or reduce greenhouse gas (GHG) emissions.

This blogpost was written by:

- William Fonta is a Senior Researcher at the West African Science Service Centre on Climate Change and Adapted Land Use (WASCAL).

- Thomas Yameogo is a postdoctoral researcher at the West African Science Service Centre on Climate Change and Adapted Land Use (WASCAL).

References

[1] W. Dick, A. Stoppa, J. Anderson, E. Coleman, and F. Rispoli, ‘Weather index-based insurance in agricultural development: A technical guide’, Int. Fund Agric. Dev. IFAD, 2011.

[2] J. Skees, A. Goes, C. Sullivan, R. Carpenter, M. Miranda, and B. Barnett, ‘Index insurance for weather risk in low income countries’, Rep. Prep. USAID Microenterprise Dev. MD Off. USAIDDAI Prime Contract LAG-1-00-98-0026-00 BASIS Task Order, vol. 8, 2006.

[3] P. Hazell, The potential for scale and sustainability in weather index insurance for agriculture and rural livelihoods. International Fund for Agricultural Development, 2010.

[4] B. Kramer and F. Ceballosa, ‘Enhancing adaptive capacity through climate-smart insurance: Theory and evidence from India’, 2017.

[5] J. Adegoke et al., ‘Review of Index-Based Insurance for Climate-Smart Agriculture: Improving climate risk transfer and management for Climate-Smart Agriculture—A review of existing examples of successful index-based insurance for scaling up’, 2017.